There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

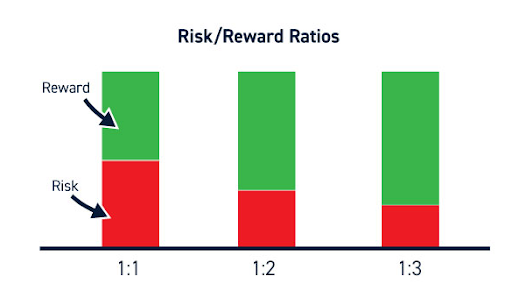

In trading, success isn't just about making profits—it's about managing risks effectively. The risk-reward ratio is a crucial tool that helps traders evaluate potential returns against possible losses before entering a trade. By using this ratio, traders can make informed decisions, optimize their strategies, and maintain a disciplined approach to risk management. This blog explores how to calculate and apply the risk-reward ratio to enhance trading performance.

Thu Jan 30, 2025

Introduction

If you’re new to trading, one of the most important things to understand is how to balance potential profits with possible losses. This is where the risk-reward ratio comes in. It’s a simple tool that helps you decide if a trade is worth taking by comparing how much you could gain versus how much you might lose. Understanding this ratio can help you make smarter and more informed trading decisions.

2. What Does Risk vs. Reward Mean in Trading?

3. How Do I Calculate the Risk-Reward Ratio in Forex Trading?

BLESIDA BENNY

FinE's in-house Finance Expert!

The content on this website is for educational purposes only and does not constitute financial, investment, legal, or professional advice.

Neither FinE, nor associated institutions, including NSE, BSE, MCX, and NCDEX, assume any responsibility for investment decisions made based on this information.

Please consult a qualified financial professional before making investment decisions.